Calendar Spreads are often used by positional traders in order to profit from the expected difference in volatility and time decay. It is one of the most used strategies when you bet on the short-term sideways movement of the market.

In today’s article, we are going to see how to implement this strategy, when to use this strategy, and factors that you should take into account while deploying this strategy.

So, without any delay, let’s get to the topic.

Calendar Spread is a derivatives strategy, where generally, you short near-term options (to benefit from sideways movement) and buy later dated options in order to hedge the previous position.

One has to keep in mind that the strike price of both legs must be the same. In other words, the strike price of shorter-dated options and the strike price of the longer-dated options must be the same. If two different strike prices are used for both legs, then it is called a diagonal spread.

The motive of this strategy is to benefit from short-term IV crush while minimising the potential loss that wild movements in the market can cause by buying later-dated options.

Basically, there are two types of calendar spreads, one is Call Calendar Spread, and another one is Put Calendar Spread. If a trader has a neutral to bullish view, they will buy a Call Calendar Spread because the trader expects sideways movement in the short term, and hence we have shorted shorter-dated option and an up move in the long term to capitalise on this we have bought longer-dated option.

• Time-Decay

In this strategy, time decay is your friend as you want short-term options to expire worthlessly. The time decay will speed up the near-dated option’s decay rate compared to the longer-dated option.

• Implied Volatility

Implied Volatility will play a mixed role in this strategy, as you want your shorter-dated options to expire worthlessly, you need Implied Volatility to decrease, and after that, you want implied volatility to go up in order to increase the price of the long option which gives you unlimited profit potential.

• Maximum Profit and Loss

Since this is a net debit strategy, the maximum loss that can occur will be debit paid itself.

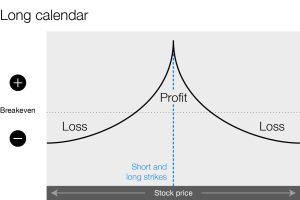

This is a limited profit strategy. The maximum profit that we can receive through this strategy will be Credit received from the short call minus the time decay of the long call. Also, considering the fact that you have taken position over two different expiration dates, determining an exact breakeven point will be difficult.

Let’s consider the example of Nifty. The current price of nifty is 16300.

In order to apply the call calendar spread, the following are the steps you should follow,

Step 1 – Short the option of near-term expiry. In our case, let’s short Nifty 2 JUN 16300 CE which is trading at 184 on Friday closing.

Step 2 – Long the later-dated expiry option of the same strike price. So, here we are shorting 9 JUN 16300 CE, which is trading at 252.

So, the net cost for this strategy is 252-184 = 68.

The payoff graph of the Calendar Spread Strategy is as follows-

So, this was a brief overview of the Calendar Spread Strategy. I think this strategy is one of the best option trading strategies to apply when you want to benefit from short-term sideways movement and have a directional view in the long term.

It is also important to note that in the above example, we have taken an example of two different weekly expiries. It is not mandatory that while initiating calendar spreads, you have to take position only across two different weeks, you can also try different combinations like week vs month, month vs month, month vs year, or any combination, but you have to choose the same strike price.

If you want to know more about Risk Management & Intraday Trading Strategies you can refer to our previous blog on

Importance Of Risk Management In Trading and 10 Best Intraday Trading Strategies.

Open a Demat Account using our link to get support from us – https://bit.ly/3gyhIWN and send your ID to [email protected]

Thank you

Want learn

Give us a call on this number for details +91-8130245100

9 AM to 9 PM: Working Hours

If you could not connect on this number then kindly fill the form here: https://boomingbulls.com/elite-trader-program-register/ and then our team will call you as soon as possible.

NICE ANISH SIR THANKS A LOT

Good explanation sir.