Intraday Trading Strategies are becoming increasingly sought after as intraday trading grows in popularity among the millennials and everyone is looking to ride the wave. Although superficially daunting, generating consistent income through stock market trading can become effortless by using highly profitable intraday trading strategies that can give you a good amount of profit if you follow them with discipline.

A trading strategy is a system that is used to buy and sell stocks with a predefined set of rules which are based on backtesting & research. However, learning intraday trading is no piece of cake. It is deeply demanding and requires enormous mental and physical effort. From testing multiple intraday trading strategies, created from scratch, to making changes along the way as we gain experience.

Although, once mastered, the monetary reward more than makes up for the hard labour, given that the best intraday trading strategies are invented and followed with utmost discipline.

The daily volatility in the stock market makes it riskier than any other profession. But if the traders calculate the risks carefully and play by the rules, they can have a successful trading career.

To save you the time and the effort, Boomingbulls Academy brings you the 10 most effortless Intraday Trading Strategies. These have been carefully developed and curated after rigorous research, perfecting the best intraday trading strategies of the real-world market. It will help traders conquer the stock market and plan their trade profitably with minimal effort.

Table of Contents:

As the name suggests, Momentum Intraday Trading Strategy is about significant changes in stock price over a short time. In this strategy, traders take advantage of the stock’s momentum to profit from short-term price movements. The duty of an intelligent intraday trader is to study the stocks showing high volatility. By knowing the volatility of the stock, an intraday trader can take positions accordingly. Based on the market direction’s speed, intraday traders can hold the trade for seconds, minutes, hours, or the entire day.

The Momentum Intraday Trading Strategy is very potent but requires speed in placing orders and good risk management techniques in order to avoid big losses and land healthy profits. The 4 most important rules of this intraday trading strategy are –

1) Selection of the stocks with high volatility.

2) Favourable risk-to-reward ratio

3) Correct position sizing & risk management

4) Technical Analysis Charting for exiting trades

The Reversal Intraday Trading Strategy offers a good risk-to-reward ratio compared to all other intraday trading strategies. As per this strategy, the bets by traders are made against the ongoing direction of the stock price. They make money off of the reversal of trends with risk-reward calculations and market data analysis. It is a complicated intraday trading strategy as the traders must accurately identify the pullbacks and their strengths. One of the supporting methods in the Reversal Intraday Trading Strategy is the daily pivot on charts, which, the intraday traders need to focus on while trading the daily low and high pullbacks.

The most used and successful intraday strategy is the Breakout Intraday Trading Strategy. This intraday trading strategy involves keeping an eye on when the stock prices rise above or fall below a certain level, resulting in an unusual increase in trading volume.

An essential skill for the Breakout Intraday Trading Strategy is speed. It is one of the most essential intraday trading strategies that does not require waiting because intraday traders know whether or not the ongoing trade will work.

It is all about observation. If the stock price rises, the intraday trader enters the trade, buys the stock, sells it at the target price, and vice versa if the stock price falls.

In trading, timing the market is essential, primarily for intraday traders. In the breakout trading strategy, timing plays a vital part in making a critical trade decision. It involves recognizing the limit points, when the stock prices rise above or fall below the defined time interval. If there is a rising trend and the price continues to go above the limit point, the traders consider long positions and buy the stocks.

On the flip side, if the prices fall below the limit point, the intraday trader will consider short positions and sell the stock. The basic idea behind the breakout intraday trading strategy is that if the prices cross the limit points, they will be more volatile and continue the movement in the same direction.

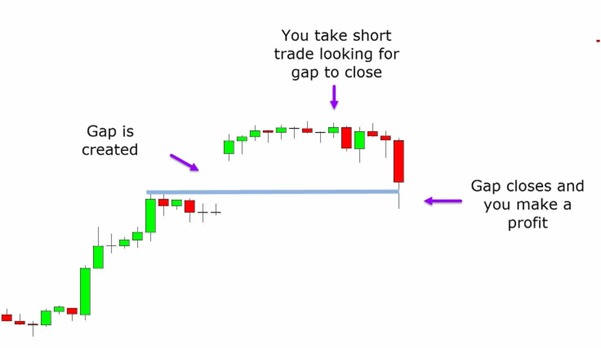

It is normal to find stocks that do not have pre-market volume and open at a gap from the previous day. If the gap opens higher than the previous day’s closing price, it is called the gap up and if it opens lower than the previous day’s closing price, it is called the gap down. In such cases, news acts as a catalyst to either pump or dump the price swiftly.

Intraday traders look for such stocks and trade in them, believing the gaps will close by the end of the day, meeting the previous day’s closing price. This strategy is excellent for those who want small but quick profits without much risk.

This intraday trading strategy focuses on gaps. Gaps are on the stock charts where no trades are executed, i.e., the stock price skips all those points. These gaps can be formed due to several elements like news and earning-related announcements of the underlying stock company.

Gaps occur primarily during opening hours when there is a significant gap between demand and supply. The traders trade into these gaps to make money before they get balanced by vanishing. In the Gap Intraday Trading Strategy, the trader looks for a gap and takes a position towards the direction as a minor trend. When gaps occur opposite to the minor trend, the opposite direction is taken with a strict stop loss.

Stock market trends are one of the most desirable indicators of how the market functions but there needs to be a differential point that could help us know whether the trend will continue. This is where the moving average comes into play. The moving average (MA) plays an important role in this intraday trading strategy. When the prices go above the moving average and sustain, it is known as the uptrend.

On the other hand, when the prices go below the moving average and continue to be there, it is known as the downtrend. The key to a Moving Average Crossing Intraday Trading Strategy is picking such stocks at the right moment. They are affected by external factors such as news about the stocks or the sectors they belong to.

All stocks have a moving average that predicts a stock price trend. It is more likely a price-crossing intraday trading strategy. Whenever the stock price goes above or below a moving average line, it indicates a potential change in the trend. When the stock price falls below the moving average, it results in a downtrend, and if the price increases beyond the moving average line, it results in a rising trend.

Stock prices have both short-term and long-term MAs. When the short-term average, such as a 10, 20, or 25 day MA, passes above the long-term average like 100 or 200 days MA, it generally signals an upcoming strong move and intraday traders buy. If the short-term average crashes below the long-term moving average, then intraday traders tend to sell.

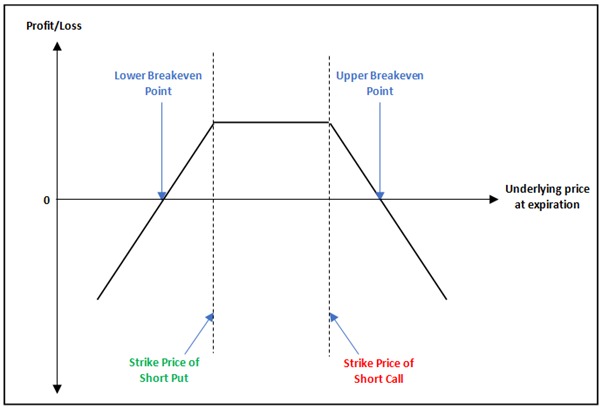

This strategy, made for option sellers, is a well-backtested and widely known one. It’s called the 9:20 straddle. This is a system trading intraday trading strategy which we will use only for Nifty, in which, everyday option sellers have to sell two options, both out of the money, 100 points away from the spot price.

Now, we place a stop loss of 25% of each option, that is, if we have sold both the options at Rs.100, then for both the strike prices, our SL will be Rs.125. We hold this position for the whole trading day, square off it at 3:15 PM, and book profits if our stop losses aren’t triggered for the whole trading day.

The pay-off graph of the short strangle looks like as follows-

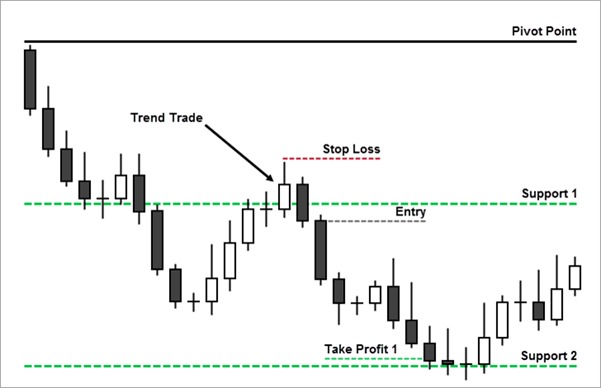

A pivot point strategy is beneficial in critical support and resistance level situations, which is also helpful in the forex market. The range-bound traders can use it as an entry strategy, while the breakout traders can understand the breakout levels.

In this intraday trading strategy, 1, 5, 10, or 15-minute timeframe is used, including the pivot points marked by the previous day’s high and low. These pivot points, once set, don’t change throughout the day. Instead, they act as the range within which the stock price is desired to move. If the price closes above or below pivot points in the given timeframes, we can employ this intraday trading strategy with tight stop loss and the next pivot point as the target.

Sometimes, the stock price rises tremendously for a few candles on an intraday time frame. Once the price reaches the extreme, a pullback starts obliquely symmetric, showing the price chart in the shape of a flag. This happens in the Flag Intraday Trading Strategy.

In the pullback zone, both highs and lows in the channel are almost parallel. This one of the most accurate intraday trading strategies. It requires much patience to form the flag pattern and upper & lower trendlines. Nonetheless, it gives the traders an incredible opportunity to generate profit before any other trend even begins.

The three soldiers’ candlestick pattern means an intense change in market sentiment regarding the stock. For example, when a green candlestick closes with small or no shadows in a predetermined time frame, it implies that the bulls in the market have won, thereby keeping the price at the top of the range for the session.

As a result, the bulls take over the trend in the trading session and close around the high of the day for three successive candles in the intraday time frame. Also, the pattern may be preceded by other candlestick patterns suggestive of a reversal, such as a Doji. It will be the opposite for red candlesticks or for bears.

Scalping is an intraday trading strategy created to profit from little price changes in a stock’s price over a short duration. Scalping is a high-speed intraday trading strategy for skilful traders, requiring precision timing and implementation at its finest.

Scalpers use day trading buying power of five to one margin (in India) to maximise gains with the most shares in the briefest time.

The small profits earned with this technique can multiply, provided the trader consistently uses an exit strategy to mitigate losses and save gains.

The Scalping Intraday Trading Strategy employs bigger position sizes for smaller price gains in the smallest period of holding time. It is performed intraday. The main objective is to buy or sell several shares at the bid—or ask-price and then swiftly sell them a few cents higher or lower for a profit. The holding time can vary from seconds to minutes.

In this strategy, a trader needs to focus on the smaller time frame interval charts, such as the one-minute and five-minute candlestick charts. In addition, price chart indicators such as short-term moving averages (8, 12, or 21), pivot points, and Bollinger bands, along with momentum indicators such as MACD and RSI, are used as reference points for price support and resistance levels.

Scalping is a popular strategy in the Forex market too. This strategy focuses on little price changes, and it would be best if you were spot on with timings as the trade duration is small. It is a very high-risk-oriented intraday trading strategy.

This is the bonus trading strategy for all the option traders who trade in Nifty or Bank Nifty.

In this strategy, we will use 3 indicators which are-

1) Average Directional Index (Use on 5 min timeframe but in ADX settings set ADX timeframe to 15min)

2) Supertrend

3) Pivot Fibonacci (Setting change> Standard to Fibonacci)

Here are the rules of the strategy–

Rule 1 – If ADX is above 20, then only look for trades

Rule 2 – Check supertrend

If the super trend indicates the buy signal, then take only buy entries.

If the super trend indicates the sell, take only sell entries.

Rule 3- Check pivots.

If ADX is above 20, Supertrend is indicating a buy signal; then initiate a buy entry only if there is a fresh breakout and set stop-loss below the recent price action level.

If ADX is above 20, Supertrend indicates a sell signal; then, you have to take the sell entry and set stop-loss above the recent price action.

Rule 4 –If you hit 50% of your target, then, in that case, shift your SL just above pivot in buy position and in sell position just above pivot to reduce the risk.

Rule 5 – You can take a maximum of 2 trades for a day.

Buy example-

Sell Example-

You can click here for a detailed video explanation of this strategy.

Intraday Trading appears to be one of the top get-rich-quick ways, but it instead requires patience and commitment. It is the most sought-after trading method in the world. The 10 best Intraday trading Strategies given above are some of the most useful and well-tested strategies for making successful trades in your trading career. Traders using any of these techniques accurately are bound to progress exponentially.

Another important thing to understand here is that in order to trade effectively; you need to have a broker who must be trustworthy and must provide a user-friendly interface. Some of the popular brokers in India, like Zerodha & Upstox, provide a user-friendly interface and are also trustworthy. So, you can open your trading & Demat account there in case you don’t have one.

Traders should be flexible and open to trying out new Intraday Trading strategies and adjusting them along the way.

1)New Trader Rich Trader

2)Trading Habits by Steve Burns

3)Trading in the zone.

You can click here to buy these books.

Open a Demat Account using our link to get support from us – https://bit.ly/3gyhIWN and send your ID to [email protected]

The Truth About Future and Options Trading – Booming Bulls Academy

What is System Trading And How Does It Work? – Booming Bulls Academy

How to Stop Getting Addicted to Trading | Top 3 Ways Explained – Booming Bulls Academy

Top 3 Lessons You Must Take From The Book “Trading In The Zone” – Booming Bulls Academy

Strangle Option Strategy | Beginner’s Guide To The Stock Market | Module 26 – Booming Bulls Academy

Thq

Awesome Article Very helpful

Thank you, Ashish, glad that you find the blog helpful. We constantly try to bring helpful blogs for our traders and will continue doing so.

Good knowledge sir

Thank you for your great suggestion for day trading. Always remember it.

Thank you, Biplab, glad that you find the blog helpful. We constantly try to bring helpful blogs for our traders and will continue doing so.

Very good and ‘easy to practice approach’ explained with great clarity.

Thank you, team Blooming Bulls !

Thank You Surya, glad that you find the blog helpful. We constantly try to bring helpful blogs for our traders and will continue doing so.

very helpful full articals sir pls provide phsycology book hindi laugage.

Thank You Ashish, glad that you find the blog helpful. We constantly try to bring helpful blogs for our traders and will continue doing so.

Thanks for making valuable information Post

Glad that you find the blog helpful; we constantly try to bring helpful blogs for our traders and will continue doing so.

Wonderful blog…….& really helps for revision……. ❤️

Glad that you find the blog helpful; we constantly try to bring helpful blogs for our traders and will continue doing so.

Thank you for updation

Glad that you find the blog helpful; we constantly try to bring helpful blogs for our traders and will continue doing so.

You are wonderful mentor who imparts true knowledge to learners or refreshers as well. Tonnes of Thanks to you if not only to your lovley Team.

Glad that you find the blog helpful; we constantly try to bring helpful blogs for our traders and will continue doing so.

very glad tosees all those fruitfui information along with self trend attraction .

very nice n informative