Pledging your portfolio can be really helpful to you, especially when you have limited trading capital. A lot of people have equity or mutual fund investments in their accounts. Still, they only have a limited amount of trading capital, and due to this, they always miss good trading opportunities. If you face this margin problem, then this article is for you!

Through this article, we will understand how you can pledge your holdings and generate additional returns on the same investment capital.

Pledging is nothing but transferring your shares, ETFs, and Mutual Funds to the broker in exchange for collateral margins. Although, you keep the ownership rights of those assets with you.

In addition to this, according to the SEBI rule, the pledged holdings will remain in your account only, and you will also be able to get dividends, bonus shares, etc. if and when it is declared, but you will not be able to sell those holdings unless you in-pledge them again.

After you pledge your holdings, you will receive a collateral margin after a haircut. Hair cut is the difference between the margin given and the market value of the share.

For example, if you pledge holdings worth Rs.1 Lakh and there is a 10% hair cut, you will only get 90,000 as collateral margin against your 1 lakh holding.

The margin received from Pledging can be used for equity trading, futures trading, & options selling. You can not use your pledged margin for options buying. The collateral amount you will get will be updated regularly according to the previous day’s closing price.

In the case of overnight F&O positions, 50% of the total margin required needs to come from cash or cash equivalents, and the rest of the 50% margin can come from the collateral margin. For example, if you want to take an overnight F&O position & a total margin of Rs.1 Lakh is required, then Rs.50,000 should be the cash margin, and for the remaining Rs.50,000, you can use the collateral margin. If you fail to do so, there will be a late payment charge of 0.035% or 12.5% p.a on the margin shortfall.

There is a simple process for pledging. Before the understanding process, it is important to know that you can only pledge the holdings that are in your Demat account. In other words, you can’t pledge your T+1 or T+2 holdings, and also, you can only pledge those ETFs, Mutual Funds, or Equities approved for pledging by your broker. Click Here to see the list of shares that you can pledge for margin in Zerodha.

Since I use Zerodha, I will explain how the process is done in Zerodha. Although, the overall process is the same irrespective of the broker you use.

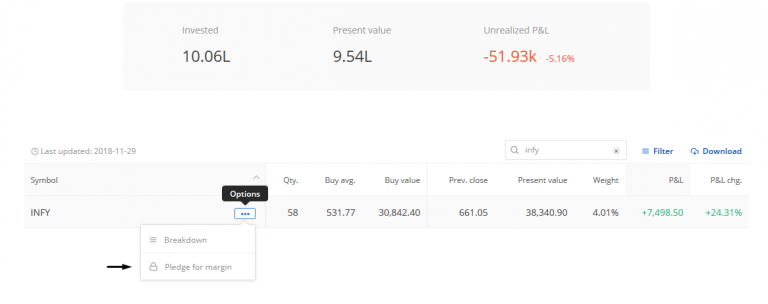

Step 1: Go to Console > Go to Holdings > Click on 3 dots.

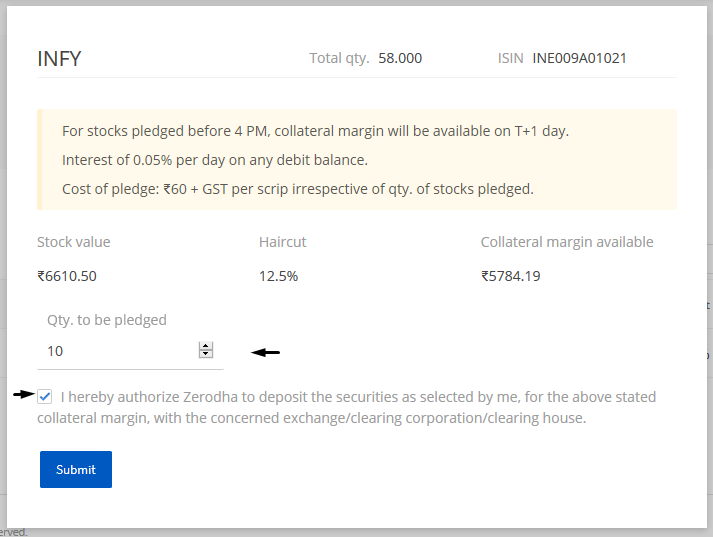

You will get the option of Pledge for margins. Once you click it, the window will pop up showing the total shares you have & hair cut for that asset.

Type the number of shares you want to pledge. Once you enter the number, you will automatically get how much collateral you will get after the haircut. After that, click the checkbox and click on submit.

Step 2 – Now, after that, you will get a CDSL link on your mail and your mobile after the market closes. This link is basically an authorization link where you will authorize this transaction by putting your pan number and OTP. Once you are done with this step, margins will be available on your trading account on the next trading day.

1) You can generate additional returns on the same money.

2) There are no additional charges or interest except the cost of Pledging, which is Rs.30/- per pledge request in Zerodha.

3) Along with stocks, you can also pledge selected mutual funds and bonds such as Sovereign Gold Bond & other selected bonds.

4) The dividends on pledged stocks will be directly credited to your bank account, and also, you will get the benefit of other corporate actions on pledged stocks, not your broker.

1) With the pledged margin, you can’t do option buying.

2) You can not sell your pledged margins immediately; you first need to unpledge them, which requires one trading day.

3) Pledge your securities if you are strict with your risk management and position sizing, as you will be using your investment money for trading.

4) You can’t carry overnight positions with full pledged margin; you will need cash margin for that.

So, these are some of the advantages and disadvantages of pledging your holdings with your broker. I hope that I was able to add value to your knowledge through this article. My advice to you will be, if you have enough trading experience and high-quality stocks in your portfolio, you can go for Pledging, of course, with strict risk management and money management rules.

Also, if you are new to trading, you probably should avoid pledging.

If you have any suggestions regarding this article, please let me know in the comment section; I will be more than happy to hear them!

If you want to know more about Risk Management & Intraday Trading Strategies you can refer to our previous blog on

Importance Of Risk Management In Trading and 10 Best Intraday Trading Strategies.

Open a Demat Account using our link to get support from us – https://bit.ly/3gyhIWN and send your ID to [email protected]

Happy learning!

Very good and informative blog

Hello thakur sir I want more indepth knowledge of stocks and crypto I’m in stock market approximately 4 years but now also I can’t pick a good stock I want your support.

Give us a call on this number for course details +91-8130245100

9 AM to 9 PM: Working Hours