Short strangle is one of the most used trading strategies that traders often deploy to get a profit from the sideways market.

Adjustments in the short strangle strategy play a crucial role because it is almost impossible to get profit from the short strangle without adjustments.

In today’s article, we are going to understand how you can create the intraday short strangle and adjust it when the market moves in either of the directions with momentum.

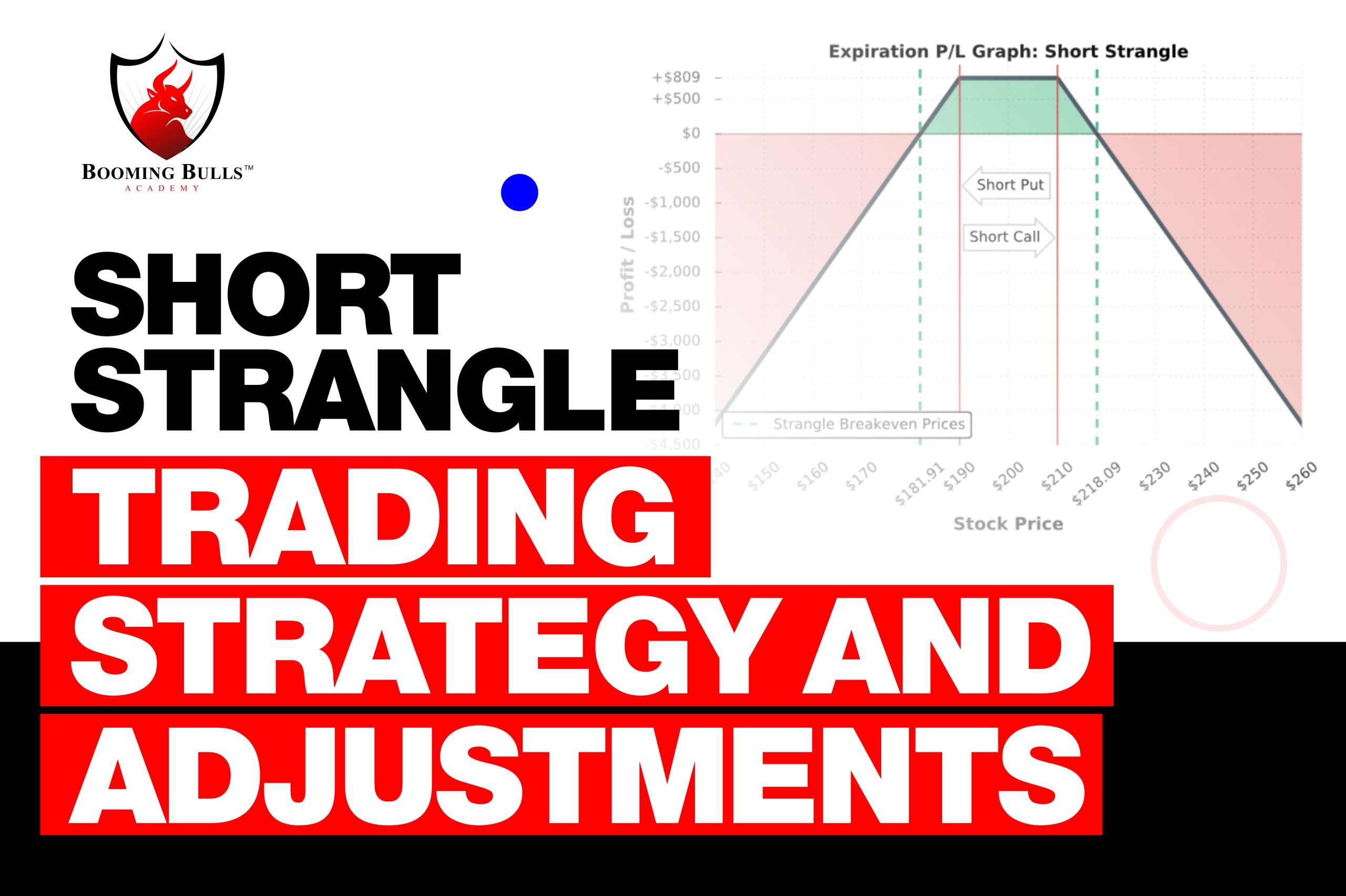

In Short Strangle Strategy, we sell out-of-the-money call options and out-of-the-money put options with the intention of making a profit from the theta decay.

For example, suppose nifty is at 17000; in order to initiate a short strangle in this scenario, we can sell 17200 CE option and 16800 PE ( generally, during a short straddle, we maintain a median distance between the spot price and out of the money options strike price) Generally as we move closer to the expiry the theta decay increases so, on Wednesday and Thursday there is a greater chance of theta decay.

On the other hand, there is less theta decay on Fridays and Mondays compared to other trading days.

Choosing the correct strike price is one of the most difficult as well as important tasks while deploying the strategy. While choosing the correct strike price, we need to refer to the option chain data, and also we need to look at the pricing of the money short straddle. For example, if the nifty is at 17000 and if at the money call option and put options both are trading around 100, then the short straddle is offering around 100+100= Rs.200 on both sides.

So whenever you are deploying a short straddle, make sure that you take the position above that range so that in case the market makes a move, you can get sufficient time to adjust your position in case the market makes a move in either direction.

As adjustments are important in short straddles, there are various ways through which you can adjust the short straddle.

As there are different ways to adjust short straddle, it depends from trader to trader and the risk appetite of every trader.

Here are various ways to adjust your short –

This is how you can adjust your short strangle using various techniques. One important thing one should understand here is that adjustments should not be made while deploying this strategy because each adjustment is a bad trade. So try to adjust your position whenever there is a need.

If you like this article, don’t forget to share it with us across all your social media handles.

Happy learning!

If you want to know more about Risk Management & Intraday Trading Strategies you can refer to our previous blog on

Importance Of Risk Management In Trading and 10 Best Intraday Trading Strategies.

Open a Demat Account using our link to get support from us – https://bit.ly/3gyhIWN and send your ID to [email protected]

Sir can I buy membership program

Give us a call on this number for details +91-8130245100

9 AM to 9 PM: Working Hours

If you cannot connect on this number, then kindly fill out the form here: https://boomingbulls.com/elite-trader-program-register/ and then our team will call you as soon as possible.

Thank u