The Indian Stock Market plays a crucial role in contributing to the growth of the economy, which makes its proper maintenance and regularisation an important factor. There are several regulatory bodies which have been either specifically established for this purpose, or have been given the role of a regulatory authority by the Government of India. The objective of these regulatory bodies in India is to maintain fairness, parity, and functioning of the Indian Stock Market. This not only ensures the ethical standards of trading in India, but also maintains the stability of the entire economy.

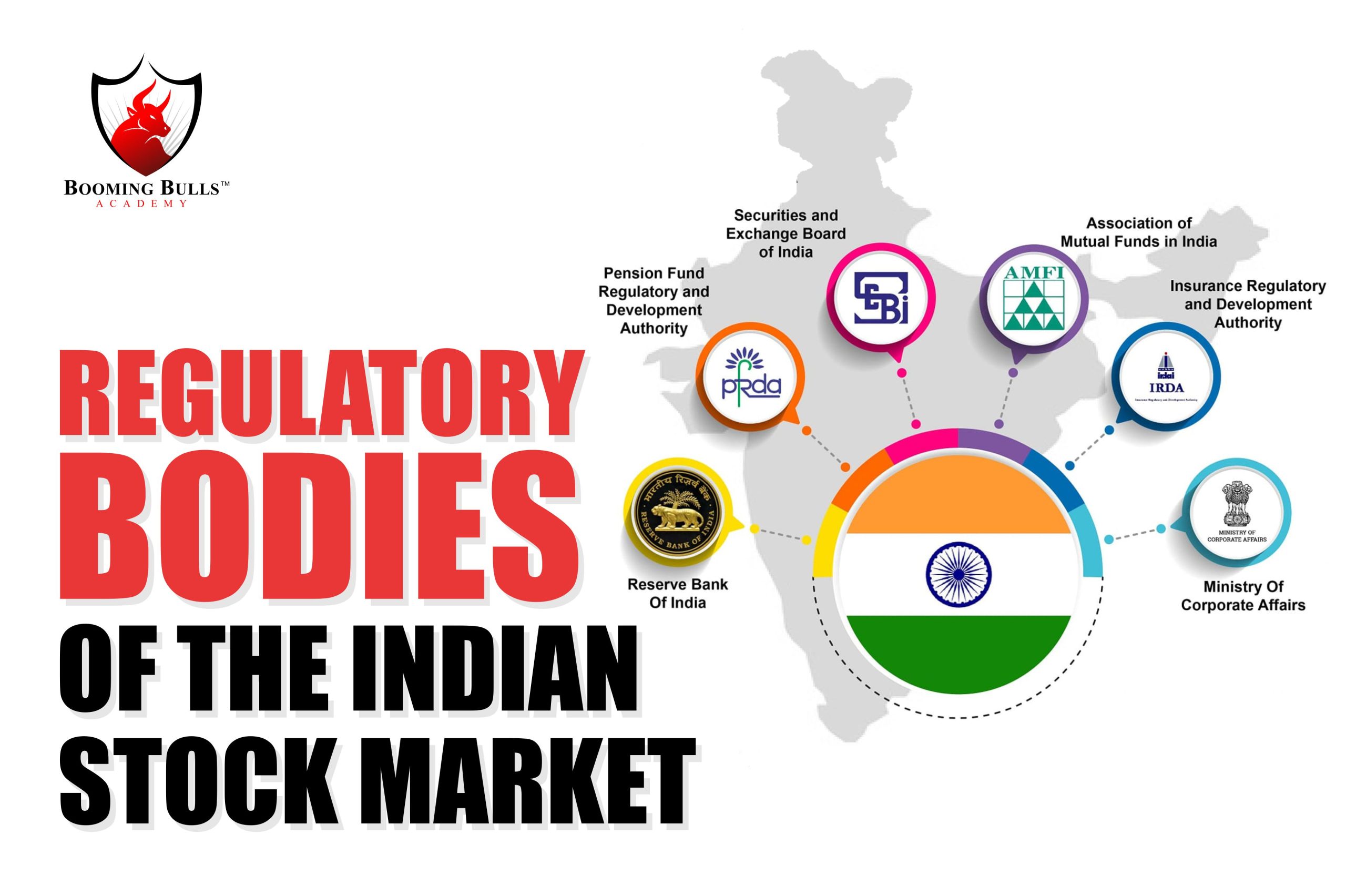

The primary regulatory bodies in India consist of the Reserve Bank of India (RBI), Securities and Exchange Board of India (SEBI), and the Ministry of Corporate Affairs, etc.

The following is a list of the functions of these regulatory bodies in detail:

The Reserve Bank of India (RBI) is the central bank of India and manages credit supply, regulates operations of banks, and helps maintain a balanced economic system. It does so by ensuring price stability in the country. In addition, it stabilizes the value of the Indian currency and ensures that the Indian Stock Market is stable and robust, and is one of the most important regulatory bodies of the Indian Stock Market.

Its functions are as follows:

The authority on everything related to the Indian Stock Market, SEBI is the most important out of all the regulatory bodies. It protects the interests of the traders and enforces a set of rules to ensure that the market functions effectively, and governs the various stock exchanges in India including the NSE and the BSE. SEBI also promotes safe and fair practices in the market in the following ways:

The Ministry of Corporate Affairs is one of the stands at the apex of all the regulatory bodies in India, regardless of whether it is related to the Indian Stock Market or not. It oversees the functioning of the industrial and services sectors, and the aforementioned regulatory bodies also fall under its purview. The MCA is also responsible for the implementation of the Competition Act of 2002, which prevents countermeasures against unfair trade practices and fraud in the Indian Stock Market.

Through this article, I hope we have informed you of the relevant regulatory bodies of the Indian Stock Market and their various functions. This will aid traders in making informed choices while trading and ensure that they know which regulatory bodies to approach in case their trades are threatened due to unfair trading tactics.

If you wish to learn more about the stock market, trading strategies, risk management, etc., in greater detail, you will find the relevant articles on the Booming Bulls Academy blog.

Open a Demat Account using our link to get support from us – https://bit.ly/3gyhIWN and send your ID to [email protected]

Happy learning!

Bro aap gajb ho

Sir please , another bomming bull academy in Kolkata we are wants this

Your 💥 Booming bull academy in kolkata as soon as possible i will be sured it you mentioned