An Option Chain is one of the most important data points that every option buyer and option seller can check while initiating their trades. Many traders check the Option Chain for a different purpose; some check it to determine crucial support and resistance on an index. Some check it for how the market is positioned to design trade with a proper risk-to-reward ratio.

As this is a bit advanced topic, it is a bit difficult to understand, but through this article, I will explain it to you in very easy language.

An Option Chain is nothing but data in a tabular format which contains all the important parameters of the option, such as listed puts, calls, their expiration dates, open interest, strike prices, and volume and pricing information for a single underlying asset within a given maturity period.

You can check the Option Chain on the official website of NSE; click here to check the Option Chain. It is helpful to check the Option Chain because by analysing it properly, you get to know what other people are thinking and how they have placed their trades so that you can have a rough idea about their psychology.

This is the most important parameter that options traders use to track how much people are interested in a particular strike price. In technical words, Open Interest is nothing but the number of contracts open on exchange at any particular time of a particular strike price.

For example, consider 1,00,000 Open Interest for 28th Jul 36000CE, i.e. there are 1,00,000 open contracts for calls at this time on exchange. Also, the contract means if I buy one call option and you sell one call option, then there is one contract between us, in simple language.

Change in Open Interest can be defined as an increase/decrease in the number of contracts of a particular strike price from its previous trading day.

Call Writing is nothing but call selling, i.e. for every option buyer who buys an option, there is an option seller on the opposite side who sells that option, and a transaction occurs between those traders.

Call unwinding is nothing but covering your long call position by selling the calls which you have bought initially. Call Unwinding can happen for various reasons, like you may want to book a profit or a loss from your initial long call position or there may be bad news in the market due to which people unwind all the long positions.

Short Covering is nothing but covering or squaring off your initial short position in the market. A short covering can occur because traders may want to book profits or losses from their initial short positions by squaring them off. It can move the market upwards whenever people start covering their short positions.

Long Build Up can occur when more traders are interested in increasing prices and to benefit from that up move traders take long positions in the market.

Short Build Up occurs when traders are interested in a downtrend and take short positions in the market.

Often, many options traders define support and resistance by analysing the Open Interest. Here, I will try to explain how we can identify support and resistance with the help of the Option Chain.

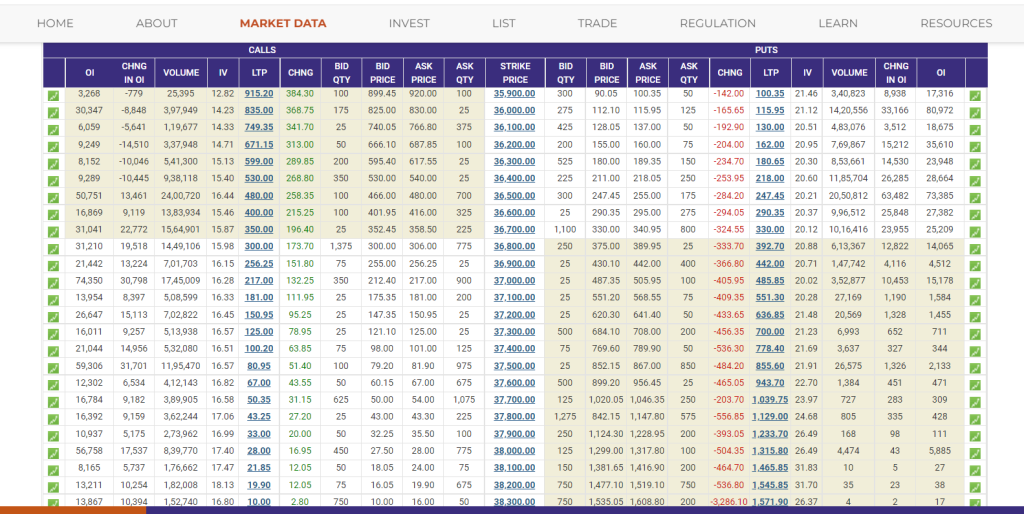

Consider, today is Friday and the Option Chain of Banknifty after market close looks like this-

To find the crucial resistance of Banknifty, find out the call strike price, which has maximum Open Interest & in our case, it is 37000 CE which has around 74,350 open contracts. By analysing this data, we conclude that at this strike price, more option buyers and option sellers are interested compared to other strike prices. Generally, option sellers are considered more smart players than option buyers because they have unlimited risk exposure and take their bets more smartly.

This doesn’t mean that option sellers always make money by selling those options. Sometimes they also book losses; that is how the market works, but most of the time, option sellers make money. So by analysing the Open Interest, we conclude that 37000 is a good resistance for bank nifty on the upper side.

On the downside, if we analyse the OI, the max OI is at 36500, which is 73,385. Hence on the downside, by analysing Open Interest, we can conclude that 36500 can act as good support for Banknifty.

Generally, round numbers like 36,500, 37000 or 37500 act as good support and resistance because they are also crucial psychological levels.

One more important point here to understand is that it is not certain that until next week bank nifty will not give a breakout above 37,000 or bank nifty will not go below 36500; it is very much possible if Banknifty starts to head towards 37000, then, in that case, all the call writer will start to feel uncomfortable.

They will start covering their positions which may result in a strong breakout, on the other hand, if Banknifty heads towards 36500 and breaks it then all the put writers will start feeling uncomfortable, and this may result in a further breakdown.

Through this article, I tried to explain to you the basics of the Option Chain and the common terminologies associated with it. If you want to know more about the Option Chain, I have made a separate video on my YouTube channel explaining how you can use the Option Chain while trading. You can Click Here to watch that video.

If you want to know more about Risk Management & Intraday Trading Strategies you can refer to our previous blog on

Importance Of Risk Management In Trading and 10 Best Intraday Trading Strategies.

Open a Demat Account using our link to get support from us – https://bit.ly/3gyhIWN and send your ID to [email protected]

Happy Learning!

Good learning… I will use this info in my trading. Thankuuu booming bulls to give a great knowledge.

Thank you, Abhishek, glad that you find the blog helpful. We constantly try to bring helpful blogs for our traders and will continue doing so.

Sir ,you covered all option chain in such a simplest manner ,i was very confused about option chain until i wrote your article but now I understood about option chain,

Thank you ❤️ very much sir

Thank you, Tushar, glad that you find the blog helpful. We constantly try to bring helpful blogs for our traders and will continue doing so.