Long Straddle & Short Straddle are probably the most straightforward option trading strategies to use. In the Beginner’s Guide to the stock market series, we have seen the basics of options. Now, we will understand how different options strategies can be implemented under different market conditions.

There are various options strategies we can use under different market conditions, but risk management rules must be followed while using these strategies.

Long straddle allows you to make a profit when the market moves in either direction with strong momentum. While this may seem like a quite profitable strategy, the underlying has to move enough to cover the cost of both options.

-Set up for long straddle

In a long straddle, you have to buy the call and put of the same at the money strike price. By doing this, you are betting on both sides of the market. If the market moves in either direction with momentum, you will be profitable.

For example, consider the Nifty is at 17500. To initiate a long straddle, you need to buy 17500 CE & 17500 PE of the same expiry. The prices of these options should almost be the same. If there is a considerable difference between the prices of these options, then do not initiate this strategy.

In our case, considering that we have taken this position on Wednesday and option prices of 17500CE & 17500PE are Rs.72 & Rs.70 respectively. If you want to hold this position until expiry, then in order to make a profit from this strategy, the nifty must move more than 142 points in two trading days on either side.

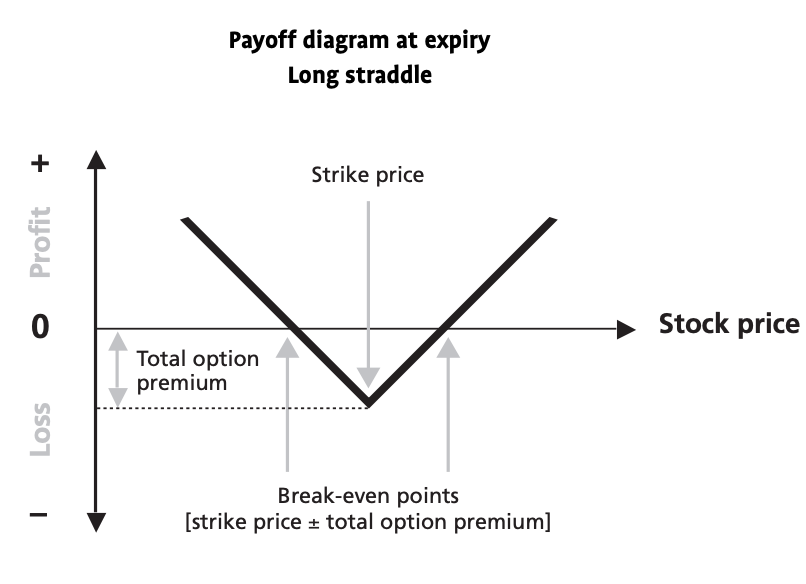

The payoff graph of the long straddle is as follows –

In the case of a long straddle, time decay will have an extremely negative effect on your position as option prices will decrease due to time decay. Long straddles are normally used at the time of big events such as election results, company’s quarterly results, or on Budget day, etc.

On normal days, long straddles will be hard to get profit from because most of the time, the index or high-quality stocks will not give you a one-directional moment with momentum. Also, one has to see the pricing of options before taking a long straddle, as the pricing of options may affect your position.

After you initiate the long straddle, you expect implied volatility to increase so that option prices can increase, and you will get profit from it.

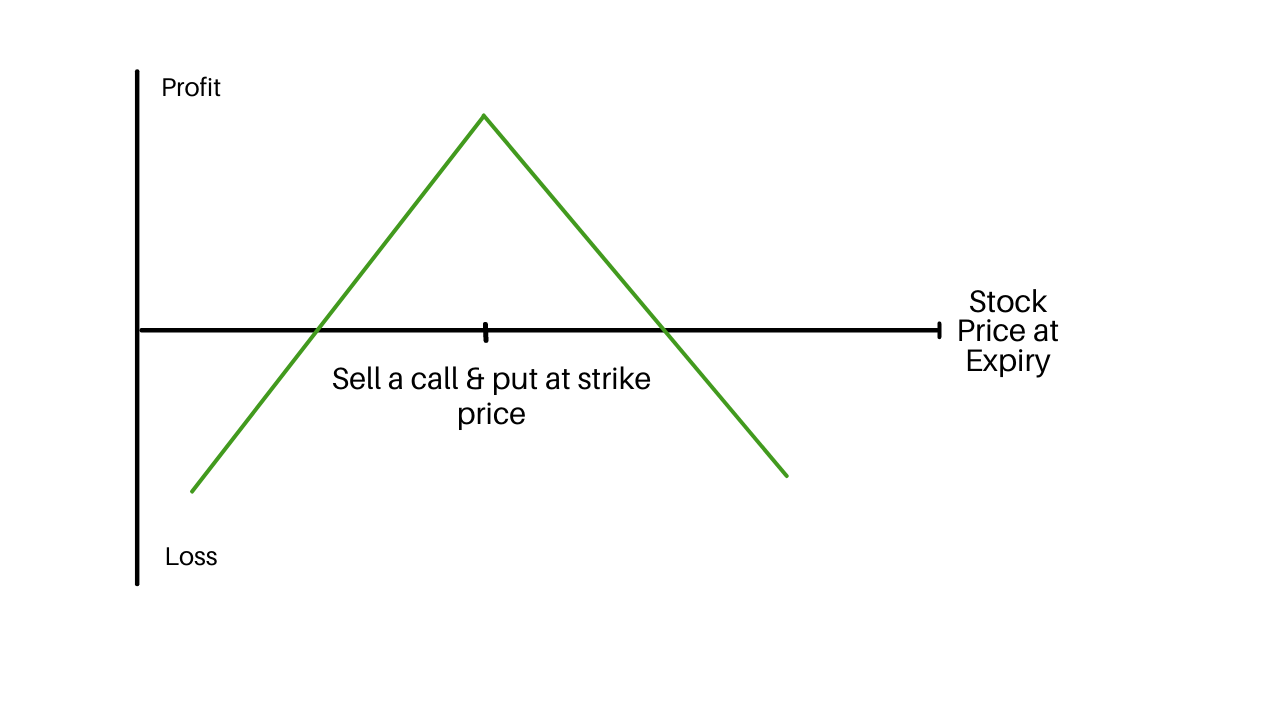

A short straddle is exactly the opposite of a long straddle. Short straddles allow you to make a profit when the market stays range-bound. In this strategy, you short both at the money put and call of the same strike price, and you collect a premium from both sides. Short Straddle is a good strategy to use when you think that the market will stay within the range.

Let us consider the previous example, considering that we have taken this position on Wednesday and option prices of 17500CE & 17500PE are Rs.72 & Rs.70 respectively; in short straddle, we take the premium from both sides so here we are getting Rs.142 as premium.

Now according to options pricing, your upper breakeven will be 17,572, and your lower breakeven will be 17430. So, until expiry, if the market stays in this range, you will become profitable.

Although short straddles will be profitable most of the time, the risk associated with short straddles will also be unlimited. One must hedge their short straddle position in order to avoid unlimited risk exposure.

The payoff graph of the long straddle is as follows –

In the case of the short straddle, time decay will be beneficial for you as you are looking for both sides of your spread to expire worthlessly. The margin required to initiate a short straddle is way too high as compared to a long straddle because here, you have been exposed to unlimited risk, but with the help of hedging, you can reduce your margin. You want implied volatility to decrease once you take the position, thus lowering your option prices.

So, this was a detailed introduction to long straddle and short straddle option strategies. I hope that through this blog, you got a clear idea about these options strategies and when to initiate these strategies. Don’t forget to share us across your social media handles if you like this article.

Also, don’t forget to turn on notifications so that whenever we post a new blog, you will get notified.

If you want to know more about Risk Management & Intraday Trading Strategies you can refer to our previous blog on

Importance Of Risk Management In Trading and 10 Best Intraday Trading Strategies.

Open a Demat Account using our link to get support from us – https://bit.ly/3gyhIWN and send your ID to [email protected]

Happy Learning!

Great content sir learnt so much from it

Sir can you please how to place short straddle along with heged position with an example so that it will be better to understand it.

Please go through the below mentioned link to understand about Short Straddle: https://boomingbulls.com/blogs/long-straddle-short-straddle/