Diagonal spreads are a bit of a complicated strategy which is a combination of a Calendar spread and a vertical spread.

In this strategy, a trader sells near-term options and buys a long-term option with different expiration dates. In a calendar spread, we used to sell near-term options and buy long-term options with the same strike price, but in the case of a diagonal spread, we sell near-term options and buy long-term options with different expiration dates and different strike prices.

So, In today’s article, we will see how to initiate diagonal spreads and what factors you should keep in mind while initiating the diagonal spreads.

1) Long Call Diagonal Spread

2) Long Put Diagonal Spread

3) Short Call Diagonal Spread

4) Short Put Diagonal Spread

This Spread consists of 2 legs- One leg consists of shorting a near-term call option, and the second leg consists of buying a longer date call option with a different strike price.

Let’s take an example of a stock that is trading at Rs.100. In order to initiate a long call spread, we need to short one out of the money option of near-term expiry. Now let’s say we shorted a 2-month later dated option with strike price 115, which let’s say trading at Rs.30, and now we to buy a later dater option, let’s say we buy a 4-month later dated option of strike price 130 which is let’s say trading at Rs.45

Now, by initiating this strategy, we are creating a neutral to bearish view on the market. Now let’s consider different probabilities-

1) Suppose, on the expiry date of the short-term option, stock expires at Rs.100, then your out-of-the-money option will expire worthlessly, and your longer-dated option will give you a slight loss because it will still have some extrinsic value. Hence, in this case, you will come out with a profit.

2) Suppose at the expiry date of the short-term option, the stock expires between 115 and 130; in that case, your shorted option will be in some loss and on the other hand, your long option will be making some profit and in this case, you will come out on break-even or slight loss depending upon the option pricing.

3) Suppose, at the expiry date of the short-term option, the stock rocketed up and expires at, let’s say, Rs.170. Now, in that case, your short-term date expiry option will give you a loss, whereas your longer dated option will give you profit but overall you will be making a loss at near-term expiry.

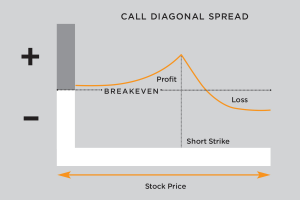

Due to the fact that this strategy is played over two different expiration months and different strike prices, determining the exact breakeven point will be difficult. Also, the maximum profit from this strategy will be limited credit received from short options – debit paid for the longer-dated option and maximum loss will be strike A – strike B + Net debit spread.

Also, to make a profit from this strategy, you should have a mixed effect of implied volatility. Initially, you want implied volatility to decrease so that your OTM short will expire worthlessly, and after that, you want IV to shoot up to gain maximum profit from your long positions.

The pay-off graph for this strategy is shown in fig-

So, this was a brief overview of the diagonal spread strategy. This is one of the best strategies you can use when you have a neutral to bullish view on the market; also, risk in this strategy is also limited because of the long options. I hope that, through this article, you were able to understand diagonal spreads and how they can be initiated across different strike prices and at different expiration dates.

If you like this article, don’t forget to share us across all your social media handles.

If you want to know more about Risk Management & Intraday Trading Strategies you can refer to our previous blog on

Importance Of Risk Management In Trading and 10 Best Intraday Trading Strategies.

Open a Demat Account using our link to get support from us – https://bit.ly/3gyhIWN and send your ID to [email protected]

Happy Learning!

Sir

online class ki fees kitni hai ?

Give us a call on this number for details +91-8130245100

9 AM to 9 PM: Working Hours

If you could not connect on this number then kindly fill the form here: https://boomingbulls.com/elite-trader-program-register/ and then our team will call you as soon as possible.